Business, 03.07.2019 12:30 chafinh1811

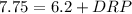

Acompany's 5-year bonds are yielding 7.75% per year. treasury bonds with the same maturity are yielding 5.2% per year, and the real risk-free rate (r*) is 2.3%. the average inflation premium is 2.5%; and the maturity risk premium is estimated to be 0.1 × (t − 1)%, where . if the liquidity premium is 1%, what is the default risk premium on the corporate bonds?

Answers: 1

Another question on Business

Business, 22.06.2019 01:40

At the local level, the main role of ctsos is to encourage students to become urge them to programs and competitive events. 1. a.interns b.trainees c.members 2. a.participate b.train c.win

Answers: 2

Business, 22.06.2019 17:30

Palmer frosted flakes company offers its customers a pottery cereal bowl if they send in 3 boxtops from palmer frosted flakes boxes and $1. the company estimates that 60% of the boxtops will be redeemed. in 2012, the company sold 675,000 boxes of frosted flakes and customers redeemed 330,000 boxtops receiving 110,000 bowls. if the bowls cost palmer company $3 each, how much liability for outstanding premiums should be recorded at the end of 2012?

Answers: 2

Business, 22.06.2019 23:00

Sailcloth & more currently produces boat sails and is considering expanding its operations to include awnings for homes and travel trailers. the company owns land beside its current manufacturing facility that could be used for the expansion. the company bought this land 5 years ago at a cost of $319,000. at the time of purchase, the company paid $24,000 to level out the land so it would be suitable for future use. today, the land is valued at $295,000. the company has some unused equipment that it currently owns valued at $38,000. this equipment could be used for producing awnings if $12,000 is spent for equipment modifications. other equipment costing $490,000 will also be required. what is the amount of the initial cash flow for this expansion project?

Answers: 2

Business, 23.06.2019 23:20

Suppose that a certain fortunate person has a net worth of $76.0 billion ($7.60×1010). if his stock has a good year and gains $3.20 billion (3.20×109) in value, what is his new net worth? suppose that this individual now decides to give one-eighth of a percent of his new net worth to charity. how many dollars are given to charity?

Answers: 3

You know the right answer?

Acompany's 5-year bonds are yielding 7.75% per year. treasury bonds with the same maturity are yield...

Questions

Mathematics, 01.03.2021 21:20

Mathematics, 01.03.2021 21:20

Biology, 01.03.2021 21:20

Biology, 01.03.2021 21:20

Mathematics, 01.03.2021 21:20

English, 01.03.2021 21:20

English, 01.03.2021 21:20