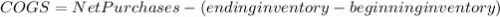

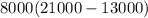

In 2018, hopyard lumber changed its inventory method from lifo to fifo. inventory at the end of 2017 of $102,000 would have been $120,000 if fifo had been used. inventory at the end of 2018 is $133,000 using the new fifo method but would have been $123,000 if the company had continued to use lifo. what is the effect of the change on 2018 cost of goods sold?

Answers: 1

Another question on Business

Business, 21.06.2019 23:30

Select the correct answer. the word intestate means that a person has died with or without a will?

Answers: 1

Business, 22.06.2019 20:30

Casey communications recently issued new common stock and used the proceeds to pay off some of its short-term notes payable. this action had no effect on the company's total assets or operating income. which of the following effects would occur as a result of this action? a. the company's current ratio increased.b. the company's times interest earned ratio decreased.c. the company's basic earning power ratio increased.d. the company's equity multiplier increased.e. the company's debt ratio increased.

Answers: 3

Business, 23.06.2019 09:40

What is an example of a functional organizational structure?

Answers: 1

Business, 23.06.2019 11:00

What are the factors that affects on the process of planning

Answers: 3

You know the right answer?

In 2018, hopyard lumber changed its inventory method from lifo to fifo. inventory at the end of 2017...

Questions

Mathematics, 09.04.2021 03:50

Health, 09.04.2021 03:50

Mathematics, 09.04.2021 03:50

History, 09.04.2021 03:50

Advanced Placement (AP), 09.04.2021 03:50

Mathematics, 09.04.2021 03:50

Mathematics, 09.04.2021 03:50

Mathematics, 09.04.2021 03:50

.

.

using FIFO than when using the LIFO method.

using FIFO than when using the LIFO method.