Business, 11.07.2019 07:00 imknutson962

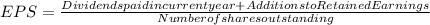

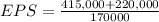

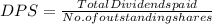

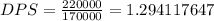

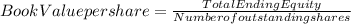

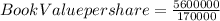

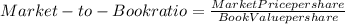

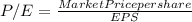

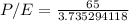

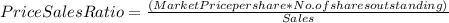

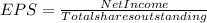

Makers corp. had additions to retained earnings for the year just ended of $415,000. the firm paid out $220,000 in cash dividends, and it has ending total equity of $5.6 million. the company currently has 170,000 shares of common stock outstanding. a. what are earnings per share? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) b. what are dividends per share? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) c. what is the book value per share? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) d. if the stock currently sells for $65 per share, what is the market-to-book ratio? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) e. what is the price-earnings ratio? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) f. if the company had sales of $7.45 million, what is the price-sales ratio? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.)

Answers: 1

Another question on Business

Business, 21.06.2019 21:40

The economic advisor of a large tire store proposes the demand function d(p)equalsstartfraction 1900 over p minus 40 endfraction , where d(p) is the number of tires of one brand and size that can be sold in one day at price p. answer parts (a) through (e) below. a. recalling that the demand must be positive, what is the domain of this function? the domain consists of all possible values of ▼ for which ▼ p d(p) ▼ does not exist. is positive. is zero. is negative. exists.

Answers: 3

Business, 22.06.2019 01:00

The following account balances at the beginning of january were selected from the general ledger of fresh bagel manufacturing​ company: work in process inventory ​$0 raw materials inventory $ 29 comma 000 finished goods inventory $ 40 comma 900 additional​ data: 1. actual manufacturing overhead for january amounted to $ 62 comma 600. 2. total direct labor cost for january was $ 63 comma 600. 3. the predetermined manufacturing overhead rate is based on direct labor cost. the budget for the year called for $ 255 comma 000 of direct labor cost and $ 382 comma 500 of manufacturing overhead costs. 4. the only job unfinished on january 31 was job no.​ 151, for which total direct labor charges were $ 5 comma 700 ​(1 comma 000 direct labor​ hours) and total direct material charges were $ 14 comma 400. 5. cost of direct materials placed in production during january totaled $ 123 comma 300. there were no indirect material requisitions during january. 6. january 31 balance in raw materials inventory was $ 35 comma 200. 7. finished goods inventory balance on january 31 was $ 35 comma 400. what is the cost of goods manufactured for​ january

Answers: 1

Business, 22.06.2019 14:20

Your uncle borrows $53,000 from the bank at 11 percent interest over the nine-year life of the loan. use appendix d for an approximate answer but calculate your final answer using the formula and financial calculator methods. what equal annual payments must be made to discharge the loan, plus pay the bank its required rate of interest

Answers: 1

Business, 22.06.2019 15:20

On january 2, 2018, bering co. disposes of a machine costing $34,100 with accumulated depreciation of $18,369. prepare the entries to record the disposal under each of the following separate assumptions. exercise 8-24a part 2 2. the machine is traded in for a newer machine having a $50,600 cash price. a $16,238 trade-in allowance is received, and the balance is paid in cash. assume the asset exchange has commercial substance.

Answers: 2

You know the right answer?

Makers corp. had additions to retained earnings for the year just ended of $415,000. the firm paid o...

Questions

Mathematics, 04.11.2020 03:00

Mathematics, 04.11.2020 03:00

Mathematics, 04.11.2020 03:00

Computers and Technology, 04.11.2020 03:00

Geography, 04.11.2020 03:00

English, 04.11.2020 03:00

Physics, 04.11.2020 03:00

Computers and Technology, 04.11.2020 03:00

History, 04.11.2020 03:00

,

,