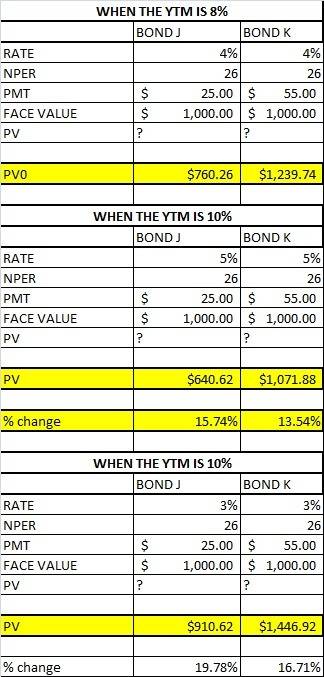

Bond j has a coupon rate of 5 percent and bond k has a coupon rate of 11 percent. both bonds have 13 years to maturity, make semiannual payments, and have a ytm of 8 percent. if interest rates suddenly rise by 2 percent, what is the percentage price change of these bonds? (negative amounts should be indicated by a minus sign. do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e. g., 32.16.) percentage change in price of bond j % percentage change in price of bond k % what if rates suddenly fall by 2 percent instead? (do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e. g., 32.16.) percentage change in price of bond j % percentage change in price of bond k %

Answers: 1

Another question on Business

Business, 21.06.2019 16:30

ernst's electrical has a bond issue outstanding with ten years to maturity. these bonds have a $1,000 face value, a 5 percent coupon, and pay interest semiminusannually. the bonds are currently quoted at 96 percent of face value. what is ernst's pretax cost of debt?

Answers: 1

Business, 21.06.2019 21:00

Each of the following scenarios is based on facts in anactual fraud. categorize each scenario as primarily indicating (1) anincentive to commit fraud, (2) an opportunity to commit fraud, or(3) a rationalization for committing fraud. also state your reasoningfor each scenario.a. there was intense pressure to keep the corporation ' stock from declining further. this pressure came from investors, analysts,and the ceo, whose financial well-being was significantly dependent on the corporation ' s stock price.b. a group of top-level management was compensated (mostly in the form of stock-options) well in excess of what would be considered normal for their positions in this industry.c. top management of the company closely guards internal financial information, to the extent that even some employees on a “need-to-know basis” are denied full access.d. managing specific financial ratios is very important to the company, and both management and analysts are keenly observant of variability in key ratios. key ratios for the company changed very little even though the ratios for the overall industry were quite volatile during the time period.e. in an effort to reduce certain accrued expenses to meet budget targets, the cfo directs the general accounting department to reallocate a division’s expenses by a significant amount. the general accounting department refuses to acquiesce to the request, but the journal entry is made trough the corporate office. an accountant in the general accounting department is uncomfortable with the journal entries required to reallocate divisional expenses. he brings his concerns to the cfo, who assures him that everything will be fine and that the entries are necessary. the accountant considers resigning, but he does not have another job lined up and is worried about supporting his family. therefore, he never voices his concerns to either the internal or external auditors.f. accounting records were either nonexistent or in a state of such disorganization that significant effort was required to locate or compile them.

Answers: 1

Business, 22.06.2019 03:00

Match each item to check for while reconciling a bank account with the document to which it relates. (there's not just one answer) 1. balancing account statement 2. balancing check register a. nsf fees b. deposits in transit c. interest earned d. bank errors

Answers: 3

Business, 22.06.2019 14:20

Frugala is when sylvestor puts $2,000 into 10-year state bonds and $3,000 into 5-year aaa-rated bonds in steady hand hardware, inc. he buys the four state bonds at a 5 percent interest rate and the three steady hand bonds at a 6.5 percent rate. sylvestor also buys $1,500 worth of blue chip stocks, and $800 worth of stock in a promising new sportswear company that reinvests its earnings in new growth. 1. (a) what is the maturity for each of the bond groups sylvestor buys? (b) the coupon rate? (c) the par value?

Answers: 3

You know the right answer?

Bond j has a coupon rate of 5 percent and bond k has a coupon rate of 11 percent. both bonds have 13...

Questions

Mathematics, 21.09.2021 20:20

English, 21.09.2021 20:20

Geography, 21.09.2021 20:20

Geography, 21.09.2021 20:20

Mathematics, 21.09.2021 20:20

Chemistry, 21.09.2021 20:20

Mathematics, 21.09.2021 20:20

Mathematics, 21.09.2021 20:20

Mathematics, 21.09.2021 20:20

English, 21.09.2021 20:20

Geography, 21.09.2021 20:20

Mathematics, 21.09.2021 20:20

Mathematics, 21.09.2021 20:20