Business, 14.07.2019 11:30 madisonnxo

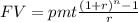

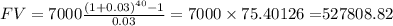

Ican't find the answerderek established his own retirement account 10 years ago. he has discovered that he can obtain a better rate for the next 10 years at 12 percent interest compounded semiannually. consequently, derek established a new ordinary annuity account (beginning amount $0.00) and he will contribute $7,000.00 semiannually into the account for the next 10 years. what will be the value of this account at the end of the 10-year period? a)$83,652.59b)$257,502.00c)$244,707 .61d)$264,501.86

Answers: 2

Another question on Business

Business, 22.06.2019 03:10

Jackson is preparing for his hearing before the federal communications commission (fcc) involving a complaint that was filed against him by the fcc regarding the interruption of radio frequency. the order to "cease and desist" using the radio frequency has had a detrimental impact on his business. once the administrative law judge prepares his or her initial order, jackson has no further options. no, jackson can request that the matter be reviewed by an agency board or commission. yes, once the initial order is presented, it's only a matter of time before the order becomes final.

Answers: 3

Business, 22.06.2019 14:30

Which of the following is an example of a positive externality? a. promoting generic drugs would benefit people. b. a lower inflation rate would benefit most consumers. c. compulsory flu shots for all students prevents the spread of illness in the general public. d. singapore has adopted a comprehensive savings plan for all workers known as the central provident fund.

Answers: 1

Business, 22.06.2019 17:20

Andy owns islander surfboard inc. in the past, andy has always given his employees bonuses during the holidays if they reached certain sales goals. this year, even though the company is thriving, he decided to cut bonuses from employees and award them to himself instead. what ethical theory of leadership is andy following?

Answers: 1

Business, 23.06.2019 01:20

The cook corporation has two divisions--east and west. the divisions have the following revenues and expenses: east westsales $ 603,000 $ 506,000 variable costs 231,000 300,000 traceable fixed costs 151,500 192,000 allocated common corporate costs 128,600 156,000 net operating income (loss) $ 91,900 $ (142,000 )the management of cook is considering the elimination of the west division. if the west division were eliminated, its traceable fixed costs could be avoided. total common corporate costs would be unaffected by this decision. given these data, the elimination of the west division would result in an overall company net operating income (loss) of: multiple choice$91,900$(64,100)$(142,000)$(50,100)

Answers: 3

You know the right answer?

Ican't find the answerderek established his own retirement account 10 years ago. he has discovered t...

Questions

English, 21.10.2020 09:01

English, 21.10.2020 09:01

Arts, 21.10.2020 09:01

Mathematics, 21.10.2020 09:01

Biology, 21.10.2020 09:01

History, 21.10.2020 09:01

Biology, 21.10.2020 09:01

Chemistry, 21.10.2020 09:01

Mathematics, 21.10.2020 09:01

Mathematics, 21.10.2020 09:01

Biology, 21.10.2020 09:01

Computers and Technology, 21.10.2020 09:01